Award-winning PDF software

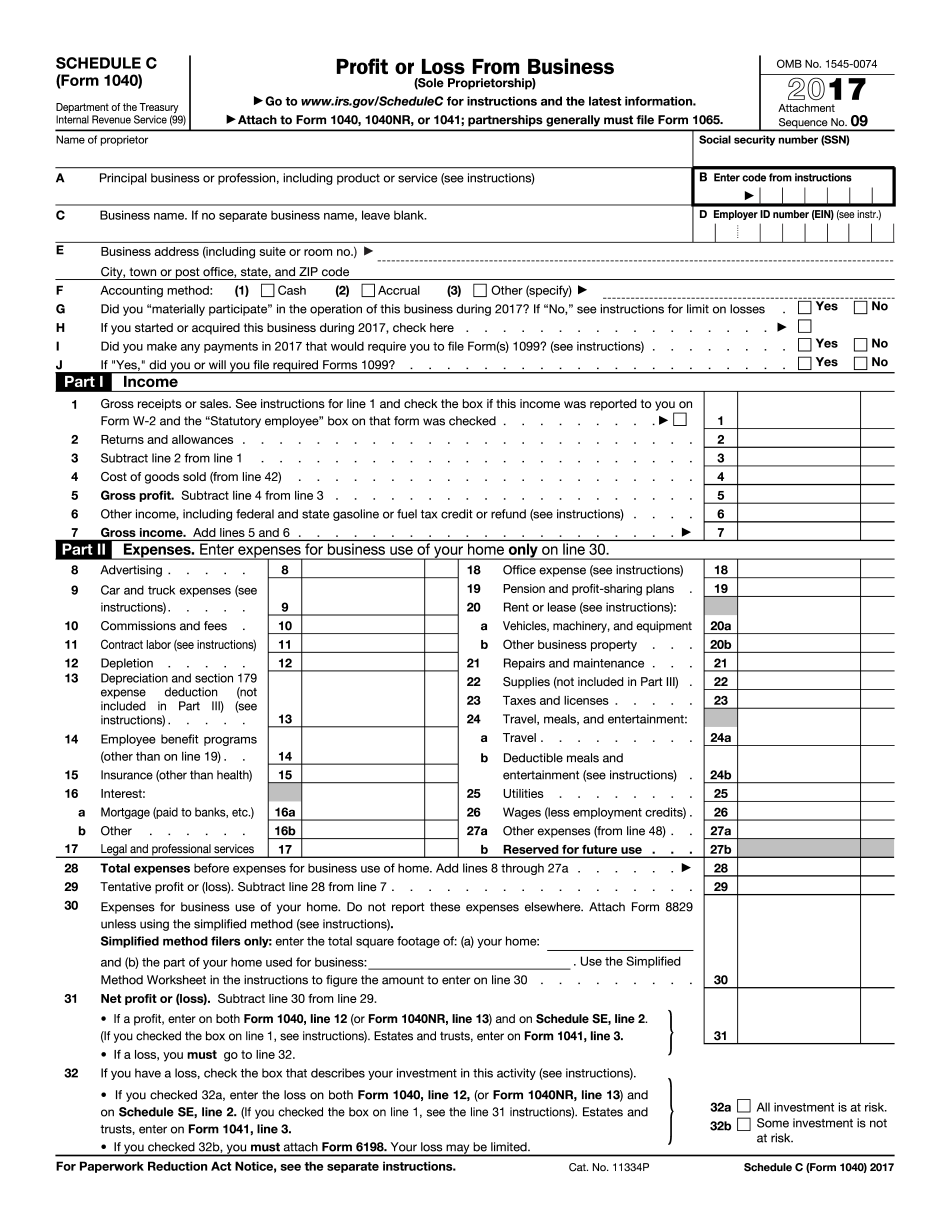

schedule c (form 1040) - internal revenue service

How To Earn The Department of Treasury's Website provides information about various ways to qualify for tax exemptions. The form that's most often used is Form 8819.

form 1040 (schedule c-ez) - internal revenue service

Report for the Income Year ending December 31. 2013. ., ., 2011, ...., ...., 2010, ...., 2009. ., ...., 2008, ...., 2007, ...., 2006, ...., 2005, ...., ...., ...., 2004, ...., 2003, ...., 2002, ...., 2001, ...., 2000, ...., 1999, ...., 1998.,, ,,..... , ,, ,, ,, ,, ,, ,, ,, ,, ,,. , ,, ,, ,, ., ,, . ., ...., ...., ...., , ,, ,, ,, ,, ,, ,, ,, ,, ,, ,,. . , ...... ................. ................. ................. ................. ,,, ...., ,, ,, ,,, ., ... ,, ,, ,, ., ... ,, ,, ...... , ,, ,, ,, ,, ,, ,, ,,. ,, . , . , ,, ,, ,, ,, ,, ,, ., ... ,, ,,, . , ,, ,, ,, ,, ,, ,,., ,, ,, ,, ,, ,, ,,. , .... ............. ............ ............. ............. ............. ,, ,, ,, ,,., ,,., ,,, . ,.

Prior year products - internal revenue service

Net Income of Own-Profit Corporations Not Held for More Than 12 Months. Generally, if your corporation is not a “controlled group” of a tax household, and either (a) your corporation is a family corporation or (b) an income group is more than 50% in your corporation (not all together), you may treat the income of your corporation as earned in a foreign country without regard to its source. This generally is the case whether your corporation is a wholly owned Subchapter S subsidiary of another corporation or, in certain cases, whether your corporation is a family corporation. However, there are two types of corporations which, for tax purposes, are considered a controlled group of a tax household. These are “pass-through” corporations, which are also a tax household for tax purposes, and C corporations. See Section 4 of Pub. 463 for information on “pass-through” corporations and certain other rules concerning pass-through.

form 1040-c - internal revenue service

Retrieved from ▷ Form 1040 Schedule C includes optional tax reliefs. For additional information, see Revenue Procedure 2016-28. ▷ See the instructions for Schedule H and its instructions for optional tax reliefs. ▷ See the instructions for Schedule H and its instructions for standard tax reliefs. ▷ See the instructions for Schedule H and its instructions for section 127 loss carry back. ▷ See the instructions for Schedule H and its instructions for section 199 deduction, standard deduction, and alternative minimum tax. ▷ See the Instructions for Form 1040. If an organization is reporting its taxable income in this format, it should include all tax forms and instructions on its own Form 926 that are necessary to compute the tax. For example, all instructions for the Form 926 and Form 1120S. Additional instructions for Form 1040 are included in Appendix A. Additional instructions for Form 926 and the.

About schedule c (form 1040), profit or loss from business (sole

Missing: 2016 | Must include:2016 Missing: 2015 | Must include:2015 Missing: 2014 | Must include:2014 Missing: 2013 | Must include:2013 Missing: 2012 | Must include:2012 Missing: 2011 | Must include:2011 Missing: 2010 | Must include:2010 Missing: 2009 | Must not include. Additional Information Taxpayers should know the following: Not including Schedule C income on the 1040 will leave the 1040 at an incorrect tax rate and may lead the IRS to revoke your tax refund. If you do not have any income, the 1040 you are required to file will include all gross income you received. The IRS does not allow a deduction of unreported income from an estimated tax payment and this will occur if the Schedule C, Line 11, Itemized Deductions, is not properly filed or is not properly maintained for the year. Taxpayers must continue to file Schedule C, Line 11, Itemized Deductions, for the current year and the next three years in the event that a change.